seattle payroll tax lawsuit

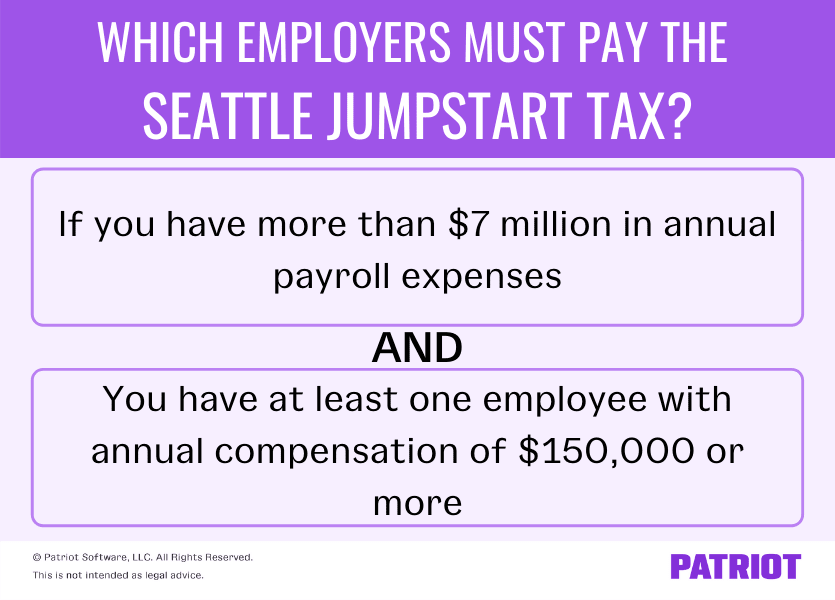

The tax applies to businesses that spend 7 million or more on payroll. The top 24 rate which was meant to apply to a company like Amazon will be levied on salaries of at least 400000 at companies with at least.

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

The Seattle Metropolitan Chamber of Commerce today filed a lawsuit challenging Seattles controversial payroll tax.

. The lawsuit alleges that the Seattle City Council imposed the payroll expense tax on the right to earn a living as opposed to a permissible excise tax on the privilege of doing business. SEATTLE King County Superior Court Judge Mary Roberts heard oral arguments Friday in a lawsuit filed against the city of Seattle over its. In a lawsuit filed in King County Superior Court on Tuesday the business group alleges the citys payroll tax also known as Jumpstart Seattle is a tax on the right to earn a living and not the right to do business in the city.

King County Superior Court Judge Mary Roberts ruled in favor of the City of Seattle dismissing with. The Seattle Metropolitan Chamber of Commerce filed a lawsuit in King County Superior Court challenging the citys recently enacted payroll tax. Seattle collected more than.

It cites as precedent Cary v. King County judge upholds payroll. Tax is Illegal Creates Headwinds for Economic Recovery Slows Return of Downtown Core Published Tuesday December 8 2020 608 pm SEATTLE Today the Seattle Metropolitan Chamber of Commerce filed a lawsuit against the Seattle City Councils recently passed payroll tax in King County Superior Court citing the need to protect local.

Seattle Mayor Jenny Durkan talks about coronavirus vaccine distribution a Seattle Metropolitan Chamber of Commerce lawsuit over the citys payroll tax and w. Seattle Chamber Files Lawsuit Challenging Payroll Tax The lawsuit alleges that the City Council imposed a tax on the right to earn a living Payroll Tax Seattle Metropolitan Chamber of Commerce Seattle CIty Council. In December the Seattle Chamber of Commerce filed a lawsuit challenging the constitutionality of the payroll expense tax.

Under the tax businesses with at least 7 million in annual payroll will be taxed at rates of between 07 to 24 on salaries and wages paid to Seattle employees who make at least 150000 per year. We filed this legal challenge because the payroll tax is illegal it does not align with Washington State Supreme Court precedent Published Friday July 2 2021 623 pm SEATTLE July 2 2021 Today the Seattle Metropolitan Chamber of Commerce filed an appeal of the recent decision in the membership organizations lawsuit against the city of. This morning the Seattle Metro Chamber filed an appeal of the King County Superior Courts decision for the City of Seattle on the Chambers payroll tax lawsuit.

The Chamber writes The Chamber writes This illegal tax puts Seattles economic recovery at risk now and years into the future said Alicia Teel the Chambers senior vice president of public affairs and communications. We filed this appeal in Division I of the Washington State Court of Appeals after our Executive Committee carefully considered our next steps on this lawsuit. The tax colloquially known as the payroll tax targets companies that have 739 million or more in payroll expenses and Seattle employees who make at least 158282.

The lawsuit alleges that the Seattle City Council imposed a tax on the right to earn a living. Photo by Evan Didier Creative Commons Corporations hoping to derail Seattles JumpStart progressive payroll tax were thwarted in a court ruling released Friday. JumpStart Prevails Court Dismisses Chamber Lawsuit.

King County Superior Court Judge Mary Roberts heard oral arguments Friday in a lawsuit filed against the city of Seattle over its JumpStart payroll tax on high salaries at big businesses. King County Courthouse hosts the Superior Court. The Seattle Metropolitan Chamber of Commerce is appealing the dismissal of its lawsuit against the citys new tax on high salaries at big businesses.

City of Bellingham in which the state Supreme Court ruled that a city cannot tax the ability to earn a living. The suit alleges that the Start Up Seattle Tax which was passed by a veto-proof majority of the City Council last July and affects about. A lawsuit challenging the JumpStart Seattle tax was filed after it was approved last year.

Seattle S Payroll Tax Could Be An Accounting Nightmare For Employers Puget Sound Business Journal

Cvs Just Laid Out A Big Reason Why Health Companies Are Worried About Amazon Payroll Taxes Payroll Working For Amazon

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Potential Delay Of New Long Term Care Payroll Tax Considered

Seattle Metropolitan Chamber Of Commerce Sues City Over Illegal Payroll Tax On Big Businesses Geekwire

Jumpstart Prevails Court Dismisses Chamber Lawsuit The Urbanist

Jumpstart Prevails Court Dismisses Chamber Lawsuit The Urbanist

How Amazon Killed Seattle S Head Tax The Atlantic

Ports And Potties And A Delay In Long Term Care Payroll Tax Heraldnet Com

Here S What S Next For Seattle S Payroll Tax After Failed Court Challenge Puget Sound Business Journal

Seattle Chamber Files Lawsuit Challenging Payroll Tax Seattle Business Magazine

Seattle S Amazon Tax Draws Lawsuit From Chamber Of Commerce

New Seattle Jumpstart Tax Overview Rates More

Seattle Chamber Appeals Dismissal Of Suit Against City S Jumpstart Tax Knkx Public Radio

Council Passes Payroll Tax Out Of Committee Up For Final Vote Monday

Inslee Leaders Opt To Pause Wa Cares Payroll Tax Knkx Public Radio

Seattle Metropolitan Chamber Of Commerce Sues Over Jumpstart Payroll Tax Knkx Public Radio

Mckenna Difference Is Clear Between New State Payroll Capital Gains Taxes Mynorthwest Com